CASH IS PILING UP!

EVERYWHERE...

CHALLENGE ACCEPTED

USE BEHAVIORAL TECHNOLOGY TO TURN SAVERS INTO INVESTORS

HOW DOES IT WORK?

A SAAS-BASED SOLUTION IN 3 SIMPLE STEPS

The Conversion Engine goes beyond standard profile-based advice for more traditional investors. It turns wealthy savers into investors by acknowledging their clear preference for savings.

The hyper-personalized journey channels their fear and reluctance by bringing the investment story differently with a lot more focus. It enables an explicit advisory flow with an execution-only feel.

At the end of the process, the wealthy savers gave us a risk profile and an amount ready to be invested.

BUSINESS CASE

FERTILE GROUND FOR DIGITAL CONVERSION

CASH IS AVAILABLE

LOW INTEREST RATES

MOBILE IS UBIQUITUOUS

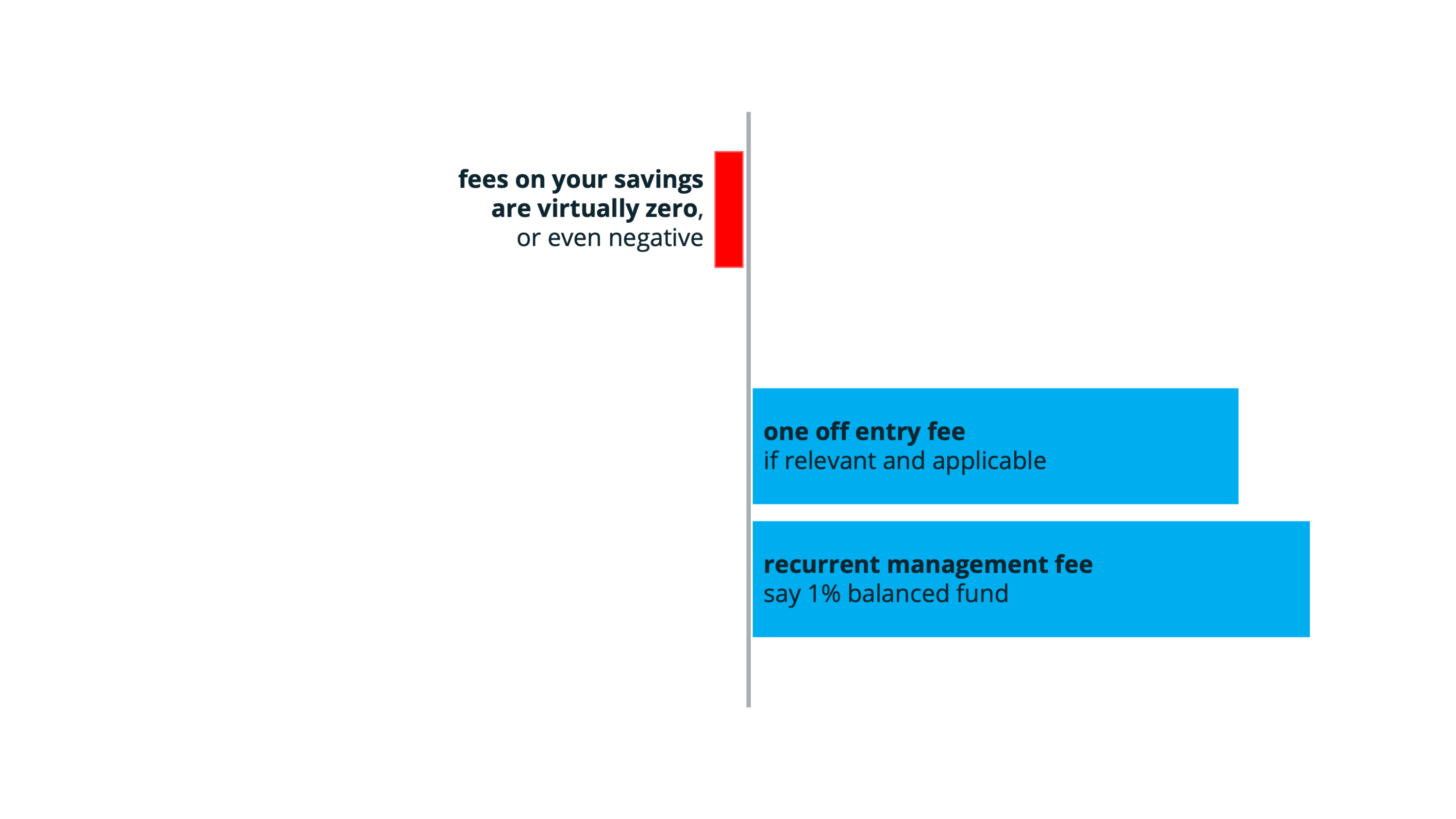

DIGITAL FEE BUSINESS

OBVIOUS CASE: INVESTMENTS YIELD MORE FOR BANKS AND THEIR CLIENTS

-

- Many banks aim to grow their fee business by converting (part of) their savings into investments through their digital channels

- Many banks aim to grow their fee business by converting (part of) their savings into investments through their digital channels

-

- Our solutions have a proven track record in increasing digital engagement when human encouragement is essential although lacking

-

- The Conversion Engine particularly targets first-time investors amongst wealthy savers

BOOST DIGITAL CONVERSION

BEHAVIORAL SMARTS ENABLE PERFORMANCE

≥ 40%

DIGITALLY CONVERT FIRST-TIME INVESTORS

- 25years

AT A MUCH YOUNGER AGE ON AVERAGE

+ 10%

INVESTING MORE AFTERWARDS

HOW CAN WE HELP BOOST YOUR BUSINESS?

We work with ecosystem leaders, financial instutions, and FinTech worldwide. Just drop us fill-out the form below, and one of our team-members will revert to you as soon as possible.